|

Getting your Trinity Audio player ready...

|

INP

ISLAMABAD: The World Health Organization (WHO) has released a report debunking the myths about illicit trade of cigarettes in the market created by multinational companies.

It says that “illicit trade market in Pakistan ranges from 9 to17 percent of the total cigarette market. However, none of the studies has estimated the extent of the counterfeit issue.”

The study titled “Study on Incidence of Illicit trade of cigarettes in Pakistan: A case study for Islamabad Capital Territory’ also stressed that the most effective way to reduce tobacco consumption is to increase the prices of tobacco products.

“As part of this study, WHO conducted a survey of cigarette retail market in Islamabad to determine the quantum of illicit cigarette packs. Of fifty union councils in Islamabad, we selected 10 union councils using a multistage sampling technique. Our numerator collected 500 empty cigarette packs from vendors, streets and garbage depots/dumps in each union council,” says the study.

The world’s top health body emphasized that the prices of tobacco products in Pakistan should be increased by taxing the tobacco industry.

According to the study which is based on Pakistan Bureau of Statistics data, tax evasion on domestically produced cigarettes in 2015-16 amounted to Rs 53.8 billion in which Rs 38.9 billion which is above 72 percent of the total share was evaded by legitimate sector.

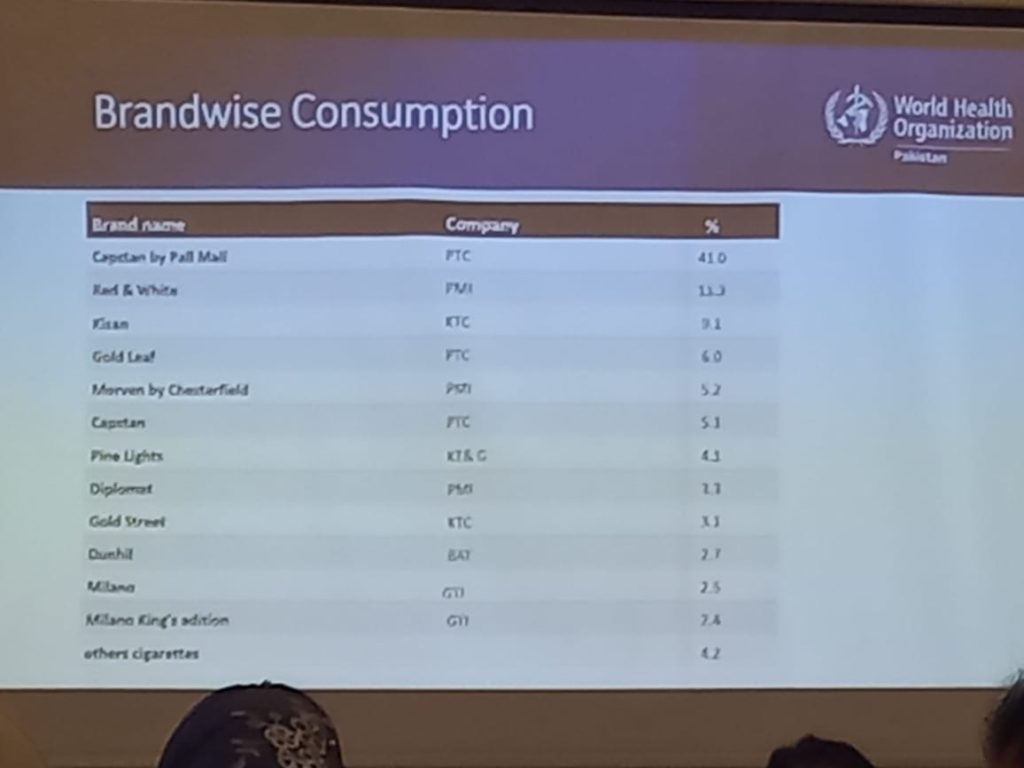

“Pakistan Tobacco Company (PTC) is one of the largest tobacco companies with a market share of over 56 percent in the Islamabad market. With a market share of more than 20 percent, Philip Morris International (PMI) is the second largest company. It is estimated that Khyber Tobacco Company (KTC) has a market share of 9.5 percent and is the third largest tobacco company,” it says.

The study found that the illicit market share is around 23% out of which 47% is smuggled and 45% is Non Tax Paid. The study reveals that 8% of the illicit market share is of counterfeit cigarettes.

Anti-tobacco activists have pressed the government to raise tobacco taxes to 70% of the retail price, in line with WHO guidelines, to combat the alarming rate of tobacco consumption among youth.

Malik Imran Ahmed, Country Head of the Campaign for Tobacco-Free Kids (CTFK), said, “With over 60% of the population comprising youth, it’s crucial for the government to protect them from the ills of tobacco use,” he said, “as the move is expected to generate additional revenue, surpassing Rs 200 billion by year-end,”

Author Profile

Latest entries

- February 9, 2025ExecutionCapital Calling and Dr. Hassan Shehzad’s change-making activism for tobacco cessation

- January 7, 2025Clean & GreenReported misconduct of Vital Strategies, CTFK comes as a shock

- May 29, 2024Business & TradeCapital Calling denounces illicit trade, demands tax raise on tobacco

- May 26, 2024Listening PostCall to increase tobacco tax to counter smoking